Which Phrase Best Describes Mortgage Collateral

Credit-Loss Ratio The ratio of credit-related losses to the dollar amount of MBS outstanding and total mortgages owned by the corporation. Credit Rating Borrowers are rated by lenders according to the borrowers credit.

Collateral Mortgage Definition of Collateral Mortgage A collateral mortgage is a type of loan secured against the borrowers property home through a written note of indebtedness such as the Promissory Note.

. Credit cards require borrowers to put up collateral. Most homebuyers use mortgage loans to purchase their homes. With a collateral charge an amount higher than the actual mortgage loan may be registered against your home.

5 Which of the following definitions best describes serial bonds. It is usually seen as an extra security for the lender in case the borrower defaults on the loan. Collateral is an asset that a borrower offers to a lender as a promise that the payment of the loan will be made.

Collateral is a property or other asset that a borrower offers as a way for a lender to secure the loan. A mortgage is a loan that is taken out by keeping a real estate asset as collateral. Require care titles as collateral.

What follows are 50 quotes Ive found to be the most enlightening about banking. Solution The correct answer is. Provide cash management services C.

Accept deposits to checking accounts Retail banks. If the borrower doesnt make the payments the lender can seize the asset and then sell it to get the money back. Credit Loan A credit loan is a mortgage that is issued on only the financial strength of a borrower without great regard for collateral.

The correct answer was given. The purchased property that secures the loan. Which best describes the main difference between credit provided by a credit card and closed-end credit.

Mortgage payments usually occur on a monthly basis and consist of four main parts. In Alabama what is used to make the home serve as collateral for the loan granted to purchase the home. Provide credit and debit cards B.

Make home mortgage loans A. A mortgage loan gives the lender an. Business banks _____ Both.

Offer certificate of deposit investments D. Which disclosure phrase BEST describes this health risk situation. For example if an individual takes out a 250000 mortgage to purchase a home then the principal loan amount is 250000.

The principal is the total amount of the loan given. Mortgage collateral describe the use of a property eg house to secure a loan. Secured bonds are backed by assets that can be seized if the bonds are not repaid.

Choose 2 Serial bonds are not a liability Serial bonds have different maturity dates Serial bonds are issued on the same dates. In the previous example they could register that collateral mortgage for 550000 440000 x 125. The test of sufficiency of a description under this section as under former Section 9-110 is that the description do the job assigned to it.

Which phrase below best describes the meaning of the term annual percentage rate APR. This collateral is always requested when a large amount of money is involved. A pledge of land as security for a debt In mortgage lending the word hypothecate means.

If you borrow 250000 the lender can choose to register a 300000 or 400000 amount. Secured bonds are backed by real estate mortgages or other assets. The Official Comment to this section includes.

Which of the following best describes the meaning of mortgage loan collateral. Brokers loans went from under 5. Closed-end credit must be repaid in full each month.

Collateral is an item of value that the borrower agrees to forfeit to the lender if the borrower cannot repay a loan. Does Mortgage Collateral Have to Be a House. Make possible the identification of the collateral described The phrase identification of the collateral seems to be the phrase that has begun to get attention from.

A The amount of the purchase price in relationship to the amount borrowed B The contract that reveals the cost paid when a house is purchased C A RESPA rule that requires a special document at closing D The true and actual cost of the amount financed. A mortgage will be taken out by a company or an individual who wishes to purchase a real estate asset. The collateral can help the borrower to get the loan approved and it can also allow to get a lower interest rate.

Which phrase best completes the diagram. Progress is cumulative in science and engineering but cyclical in finance -- James. A collateral mortgage is less formal.

Collateral acts as an insurance policy for lenders which can be sold to recover losses when a borrower defaults on their loan. Closed-end credit usually carries a higher APR. For a mortgage the collateral is often the house purchased with the funds from the mortgage.

If the borrower stops making loan payments the lender can take hold of the items or house designated as collateral to recover its losses on their loan. Credit cards have a line of credit that can be used as needed. Instead it is simply a promissory note that is secured with your home.

There are many lenders who will come to you with the chance to register your mortgage for up to 125 of the propertys value.

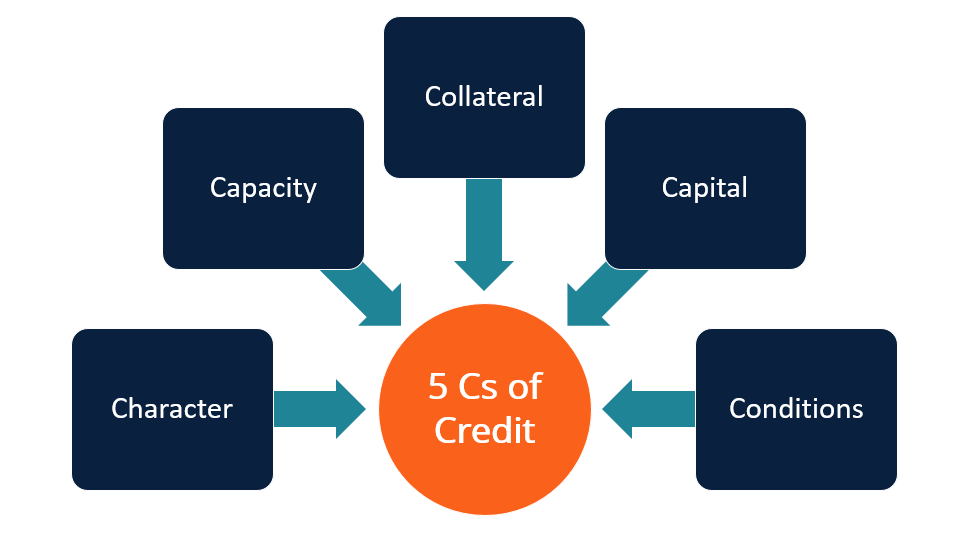

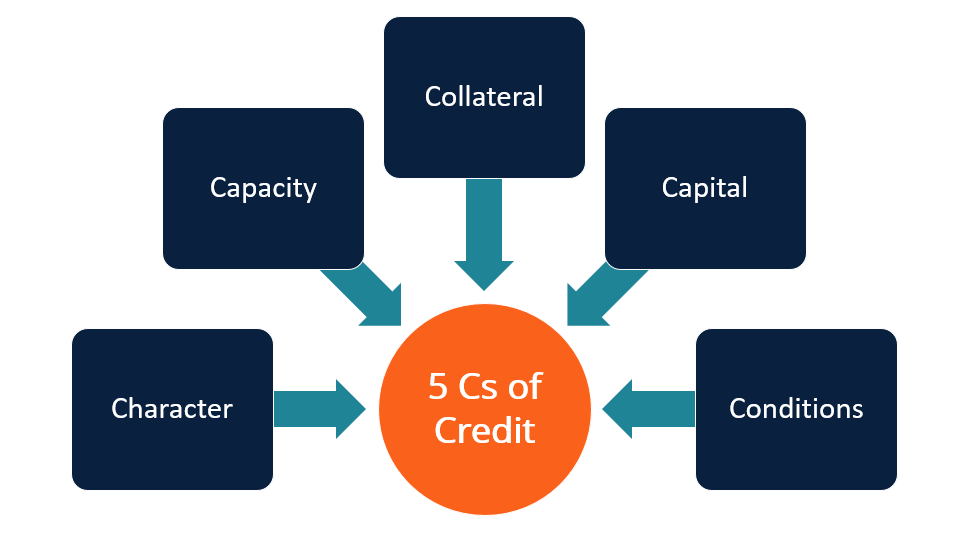

5 Cs Of Credit Overview Factors And Importance

Collateral Definition Types Collateral Vs Security

Glossary Of Real Estate Loan Terms Powerful Knowledge 24 7

Which One Of The Following Option Describe Collateral

What Is A Cd How Does It Work Ally

Which Phrase Best Completes The Diagram Business Banks Retail Banks Accept Deposits To Checking Brainly Com

/MacysbalanceSheetNov32018-146bc581861a44528f5802bbde519227.jpg)

/33165938171_420677e6fc_k-b64cb4cc181e4daabd81483d52d52377.jpg)

/MacysbalanceSheetNov32018-146bc581861a44528f5802bbde519227.jpg)

/alta-sellers-closing-statement-26837264d4044785a5d0409dae83a510.jpg)

Comments

Post a Comment